BID OPTIMIZATION

AND TRADING SERVICE

SERVICE OVERVIEW

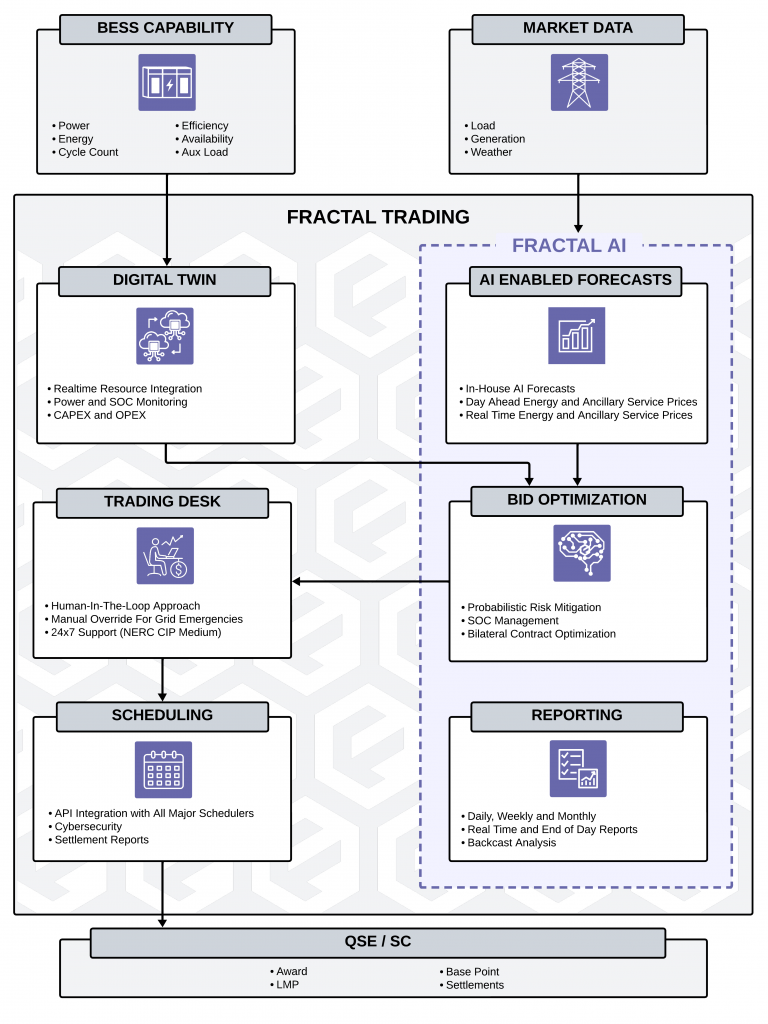

Fractal Bid Optimization and Trading Services enable energy storage operators and merchant asset owners to maximize project rate of return. The services combine market expertise, in-house forecasts, a Digital Twin, and proprietary machine learning software to generate dispatch schedules that maximize profitability, while accounting for costs (losses, degradation, and auxiliary loads).

Fractal’s proprietary “Fractal Optimizer” is a dispatch optimization software for standalone storage and PV+S assets. The Fractal Optimizer combines our in-house forecasts and Digital Twin, with linear optimization methods to generate dispatch schedules that maximize profitability, while accounting for costs (losses, degradation, and auxiliary loads). Our analysts use the Fractal Optimizer to evaluate the physical and financial impacts of millions strategies, while accounting technical limitations (SOC, DOD, warranty restrictions).

Fractal Bid Optimization and Trading Service deliverables include:

- Full-Time Dedicated Analyst / POC

- Daily Day Ahead and Real Time Energy and Ancillary Service Price Forecasts

- Daily Bid Optimization Using Fractal Optimizer

- Daily Offer Curve Submission to QSE/SC

- Monthly Detailed Performance and Benchmarking Report

- Monthly ISO/RTO Settlements Review

- Quarterly Digital Twin Calibration

| DIFFERENTIATOR | DESCRIPTION |

|---|---|

| HUMAN-IN-THE-LOOP PROCESS | The Trading Service starts and finishes with a dedicated analyst; unlike competitors that use a black box platform, Fractal balances automated processes with experienced human involvement. While Fractal’s sophisticated tools excel at processing large volumes of data at high speeds, our analysts bring an unparalleled depth of understanding and adaptability, creating a competitive advantage. Our in-house team of analysts has experience with over 10 GW of energy storage project technoeconomic analysis, supporting tier-1 energy companies (utilities, developers, and banks) since 2015. Our clients receive a dedicated analyst who works with asset owners to collectively build a trading strategy adhering to the asset owner’s risk appetite. |

| ROBUST SOFTWARE | Sophisticated in-house software tools to forecast revenue and costs to achieve bid optimization while properly accounting for financial, technical and commercial conditions |

| ADVANCED DIGITAL TWIN | For every project, Fractal builds a unique Digital Twin that models the operational costs and degradation of your actual resource based on the following parameters:

The project-specific Digital Twin is calibrated quarterly using operational data and annually based on the capacity test. This Digital Twin enables the Fractal Optimizer to co-optimize the cost and revenues while accounting for the battery storage physics. |

| FRACTAL FORECASTS | Fractal uses AI to generate day-head, real-time energy, and ancillary service forecasts. For each project, our tools ingest hundreds of thousands of market inputs (weather, load, generation, market prices, and signals) every day to train prediction models. Fractal runs 3-10 prediction models for every service and selects the best combination of forecasts. |

| FRACTAL OPTIMIZER | Fractal’s proprietary “Fractal Optimizer” is a dispatch optimization software for standalone storage and PV+S assets. The Fractal Optimizer combines our in-house forecasts and Digital Twin, with linear optimization methods to generate dispatch schedules that maximize profitability, while accounting for costs (losses, degradation, and auxiliary loads). Our analysts use the Fractal Optimizer to evaluate the physical and financial impacts of millions strategies, while accounting technical limitations (SOC, DOD, warranty restrictions). |

| TRADING DESK & SCHEDULING | For each project, Fractal formats and submits real-time offer/bid curve updates directly to the QSE/SC. All Fractal and the QSE/SC API communication is authenticated and secured using SSL/TLS encryption. |

| PERFORMANCE REPORTING | Fractal informs our clients by providing monthly performance reports to summarize financial performance. |

| QA/QC | Fractal benchmarks awards and project revenue based on Fractal’s offer and bid curves with the project’s Perfect Revenue. The Perfect Revenue includes revenue for actual market clearing prices after the market clears every day. We use these KPIs to improve our algorithms over time. |

| RISK MANAGEMENT | Fractal manages market and operational risks by:

|

| HIGH CYBERSECURITY | The Fractal Optimizer software, processes and organization are governed by NIST Cybersecurity Framework. Fractal uses in-house software development and IT/cyber personnel (no third-party contractors). |

| OPTIONAL MONITORING | In addition to Bid Optimization and Trading Services, Fractal provides 24/7 monitoring and operations options for BESS and Solar PV through our in-house NERC CIP Medium control room based in Austin, Texas. Fractal uses experienced BESS operators to monitor your projects, including technical support, troubleshooting, restoration, ISO/RTO coordination, and contractor coordination. Our job is to maximize uptime (availability and capability), protect your warranties, and keep your assets performing well. Availability is the key to maximizing revenue. |